Dividends are commonly thought of as a reward for long-term investors. Every quarter, certain public companies pay out dividends to their shareholders, who can then use them as income or reinvest them back into the company. But, since company stock only needs to be held for a day for dividend eligibility, many short-term traders like to play a game called "capture the dividend."

By employing a dividend capture strategy, investors with short-time horizons can receive payouts without worrying about the stock's long-term prospects.

Understanding the dividend capture strategy

Also known as dividend harvesting or dividend scalping, the dividend capture strategy enables day or swing traders to benefit without needing to hold the underlying stock long term. Dividend capture is a short-term trading strategy aimed at reaping income from the dividend of blue-chip or high-yield stocks through timely entry and exits. Since a stock only needs to be held for a day to receive the dividend, crafty traders can bounce in and out of stocks and still get rewarded.

Before reviewing how this dividend strategy works, it's important to be clear about the role dividends play in a portfolio. Dividends are excess portions of a company's net profits. The company can either reinvest its extra profits into the firm or reward them to shareholders through dividend payouts. Dividends usually come from established companies that aren't aiming at accelerating growth or expanding market share, which is why older blue chip stocks tend to pay the highest dividends.

How does the dividend capture strategy work?

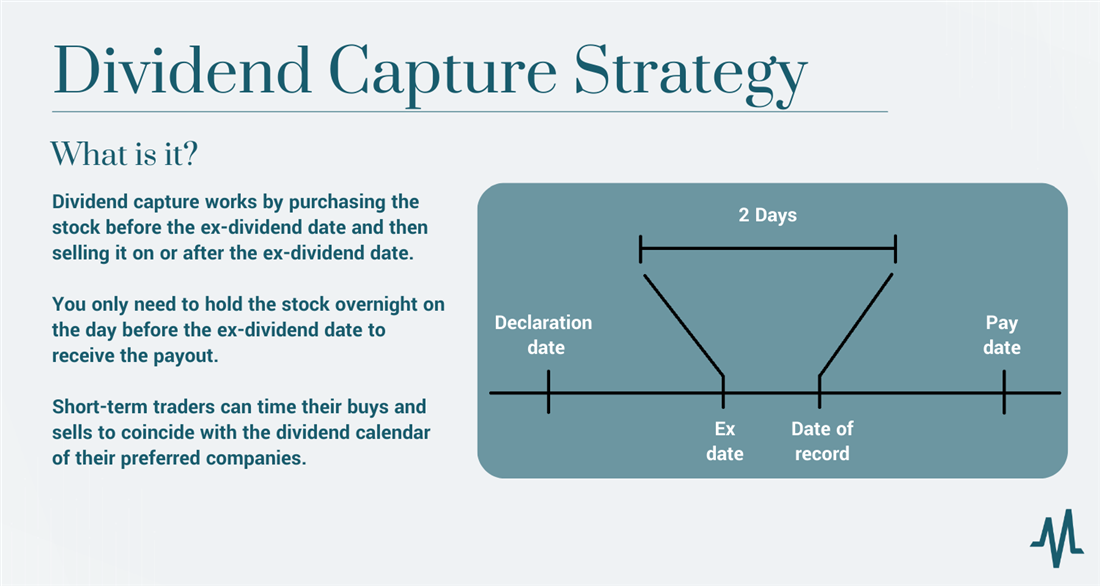

Dividend capture is when an investor buys a stock before its ex-dividend date and then sells it on or after the ex-dividend date. To effectively execute this strategy, you need to understand the dividend calendar. This tells you how much the dividend will be and when you will receive the payout. The ex-dividend date (described in the next section) is the critical day to be aware of when using this strategy.

You only need to hold the stock overnight on the day before the ex-dividend date to receive the payout. If you wish to sell the stock soon after the morning bell on the ex-dividend date, you can do so and will still receive the dividend on the payout date. Since the holding period for dividend eligibility is a single day (in reality, only a handful of hours), short-term traders can time their buying and selling decisions to coincide with the dividend calendar of their preferred companies.

Dividend timeline

Before buying any stocks, you'll need to make a dividend capture strategy calendar. Your calendar will consist of the four major dates on the dividend calendar:

- Declaration date: On the declaration date, companies announce when the next dividend will be paid (if any) and how much the payout will be. The declaration date also announces the date of record, or when investors must be on the books for dividend eligibility.

- Ex-dividend date: The date of record gets announced before the ex-dividend date (or ex-date), but the ex-dividend date comes first sequentially. The ex-dividend date is the most important date on the calendar for investors since they must own the stock before this day to receive the dividend. The date of record might be when investors' names go in the books, but the ex-dividend date is the cutoff set by exchanges. The ex-dividend date occurs a day or two before the date of record to allow trades to settle, and the company can assess the proper ownership stakes.

- Date of record: On the date of record, the company paying the dividend will note which investors are eligible to receive it. The date of record occurs after the ex-dividend date to allow trade settlement to occur. Investors need to take no action on the record date; it's merely for company bookkeeping.

- Payout date: Finally, the dividend payout hits brokerage accounts on the payout date. The payout date comes from the company issuing the dividend, but an investor does not need to own shares on this date to get the dividend. Shares may have changed hands several times between the ex-dividend date and the payout, but the investor who owned the shares at closing time the day before the ex-dividend date gets the payout.

Example of how to use the dividend capture strategy

Here's an example of this dividend strategy. Let's say you want to capture the dividend for the 3M Company NYSE: MMM and the United Parcel Service Inc. NYSE: UPS. Both companies are blue-chip stocks with a long history of raising dividend payouts, which makes them ideal securities for dividend trading.

First, you'll need to look at the dividend calendar for both companies. If you're using a dividend capture strategy, you'll want to know all four key dates, especially the ex-dividend date and the payout date. The ex-dividend date tells you when you must own the shares, and the payout date tells you when to expect your reward to hit your brokerage account. Gazing at the calendar, you notice that MMM has an ex-dividend date of February 16, and UPS has an ex-dividend date of February 17. Then, you notice that UPS has a payout date of February 28, while 3M doesn't pay until March 10. (You can use MarketBeat's dividend screener to find a comprehensive list of these dates.)

To utilize this dividend strategy, you can buy shares of MMM on February 15 and hold them overnight. At the ringing of the opening bell on February 16, you can sell your MMM shares and use the proceeds to buy UPS shares. As long as you hold the UPS shares through close, you're eligible to receive both dividends, even though you've only held each stock for a single day. Note that good faith violations (GFV) can occur if you buy and sell stocks with unsettled funds, so you may need to hold the UPS shares beyond a single day to avoid getting dinged by a GFV.

How to build a successful dividend capture portfolio

The dividend capture strategy doesn't come with a step-by-step list of instructions. Like any investing strategy, you'll need to determine your risk tolerance, time horizons and investment goals. Dividend capture requires knowledge of different stock sectors and attention to detail since you'll need to track the various ex-dividend and payout dates of various public companies.

Which types of dividend stocks are the best candidates for a dividend capture strategy? First, you'll want to compare the volatility of stocks in various sectors and find out how much stock price movement you can comfortably stand. One way to gauge volatility is to look at the stock's beta and compare it to others in the sector. For example, Kohl's Corp NYSE: KSS has a high dividend yield, but its beta is 1.83, meaning it is 83% more volatile than the S&P 500. Are you comfortable holding a retail sector stock with that much volatility? KSS shares might be a good target to purchase before the ex-dividend date and sell immediately after.

On the other hand, Dollar General Corp NYSE: DG has a 0.37 beta, meaning it's less volatile than the S&P 500. It may not pay as high a dividend as Kohl's, but the shares are stable, and analysts point to potential upside. A conservative investor looking for steady dividends and stable stock prices would likely prefer owning DG over KSS. KSS fits more into the typical short-term dividend capture playbook.

Risk management in dividend capture

Managing risk is always crucial, but dividend trading using the dividend capture strategy requires strict attention. You can’t ‘set it and forget it’ if you want to adopt a true dividend capture strategy since long-term income or capital appreciation isn’t the goal. Stock selection is paramount, and while dividends are predictable, the market has ways of throwing wrenches into carefully laid trading plans. Here are a few key risk factors that dividend capture investors must take under advisement.

- Missing ex-dividend dates: Dividend capture requires knowing a lot of dates, and if you don’t own shares before the ex-dividend date, you don’t get the payout. Make sure you keep track of both the ex-date and the payout date.

- Market risk: Imagine you get a 2% dividend yield on a company that pays quarterly, which means your dividend payment will be equal to 0.5% of the share price. But what if the stock drops 1% the day before the ex-dividend date? You’ll wind up losing money on the trade if the stock drops more than the dividend payout while the shares are in your possession (and you must hold overnight at least once to get the dividend).

- Tax risk: You don’t need to own the stock long to get the dividend, but you do need to own it for at least 2 months in order to get the best tax treatment on your dividends. If you don’t own the stock for more than 60 days, your dividend payout will be taxed as regular income, not capital gains.

Timing is everything: Best practices for dividend capture

So much of investing comes down to timing. For example, if you began investing in the 1980s, you enjoyed multiple decades of falling rates, which helped boost stock returns. If you began investing in 2005, you might have been forever scarred by the financial crisis in 2007. Timing is the most important factor in dividend capture since you need to own stocks on specific days. Keep these tips in mind when attempting this investment strategy.

- Build a dividend calendar. MarketBeat tools like the ex-dividend calendar can help you track all upcoming dates.

- Know your capital limitations. You’ll have to hold overnight at least once to get the dividend, but you also won’t get the payout right away. Always know when your payouts are due so you don’t run into cash flow problems.

- Plan for taxes. You’ll likely be receiving unqualified dividends, which means income tax and not capital gains taxes. Always set aside enough capital to pay Uncle Sam; tax penalties can negate a good chunk of your investment gains.

Tax implications of the dividend capture strategy

Taxes represent one of the downsides of the dividend capture strategy. Not all dividends are created equal: they can be qualified or unqualified. A qualified dividend is eligible for the preferential capital gains tax rates, which can be 0%, 15% or 20%, depending on your income. Unqualified dividends are subject to ordinary income tax rates, which can be as high as 39% if you're in the top tax bracket.

Long-term investors benefit most from dividends because they hold stocks long enough to meet the standards for qualification. To be classified as a qualified dividend, the investor receiving the payout must have held the stock for a minimum of 60 days. Any 60 days during a specific 121-day window will qualify the dividend, but for investors using dividend capture, this holding period is untenable to their strategy. Therefore, dividend capture investors will likely pay the full ordinary income rate on their dividend earnings. As always, consider these factors when deciding when to sell dividend stocks.

Pros and cons of the dividend capture strategy

Here are a few benefits and drawbacks of deploying a dividend capture strategy:

Pros

First, the pros:

- Simple strategy: Dividend capture trading doesn't require a detailed understanding of company balance sheets or fundamentals, nor must you be an expert on deciphering chart patterns. Very little market research is necessary to use dividend capture; you must be aware of the calendar and the payout amounts.

- Don't need to commit capital long-term: Traders using this dividend strategy can remain day or swing traders and still receive the payout. Since stocks only need to be held for a day to get dividends, no long-term capital commitment is required to orchestrate these types of trades.

- Consistent and immediate rewards: Dividend capture strategies are relatively predictable compared to other forms of short-term trading. The dates you must buy shares are known well in advance, and the company always declares the dividend payout amount well before the ex-dividend date. Unlike a box of chocolates, you know exactly what you'll get with dividend capture.

Cons

Next, the downsides:

- Not tax efficient: Unless you hold the stock for 60 days, dividends are labeled "unqualified" and taxed at your ordinary income rate. No matter your income level, the ordinary rate will always be less friendly than the capital gains rate.

- Market compensates for dividends: Mr. Market is aware of the dividend capture strategy and frequently enjoys throwing a wrench into the gears. Since the ex-dividend date is known well in advance, stocks tend to underperform on that day since buyers are no longer eligible for the payment. If you earn a 2% dividend, but the stock falls by 2% on the ex-date, you're only breaking even (or worse, considering transaction costs).

- Could underperform typical buy-and-hold techniques: Capture techniques are easy dividend trading strategies to understand but challenging to master. You won't get preferential tax treatment and may even lose money if the stock drops precipitously on the ex-dividend date. Dividend capture is more effective during bull markets than bear markets, but there's no promise of outperforming buy-and-hold investors even then.

Common pitfalls and how to avoid them

The most common pitfall of a dividend capture strategy is missing the ex-dividend date. As has been mentioned several times, if you don't own shares on the ex-dividend date, you won't get the dividend. Fortunately, this is also the easiest to avoid. MarketBeat provides a dividend screener and an ex-divided calculator that give you two ways to keep track of when a stock trades ex-dividend.

Another common pitfall is choosing a stock that drops after the ex-dividend date. Doing so could cause you to take a loss. While this risk is impossible to avoid altogether, you can look at a company's stock chart to get a sense of the kind of price movement that generally occurs around the ex-dividend date. In some cases, stocks follow predictable patterns.

Dividend capture can be an effective short-term trading strategy in certain markets, but it's not a plan to gain long-term wealth. Dividend harvesting can provide steady and reliable income without worrying too much about volatile market gyrations or confusing technical analysis. However, dividend capture strategies are very tax inefficient and aren't proven to outperform the long-term techniques of typical dividend investors.

FAQs

Here are a few frequently asked questions about dividend capture strategies:

Can you make money with dividend capture?

With careful planning and timely trading, dividend capture can be an effective income-producing strategy for short-term investments like day trading or swing trading.

How effective is dividend capture?

The effectiveness of dividend capture is debatable. In some markets, you can capture the dividend without the stock suffering too much of a hit on the ex-dividend date. But in declining markets, the dividend payout might be negated by the stock price dropping on the ex-date.

How is the dividend capture strategy taxed?

Since you hold stocks purchased using dividend capture strategies for only a day or two, the payouts will be subject to the investor's ordinary income level. You must keep the stock for at least 60 days to receive the more beneficial capital gains rate, which is too long to lock up capital for many short-term traders.

Before you consider 3M, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 3M wasn't on the list.

While 3M currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.